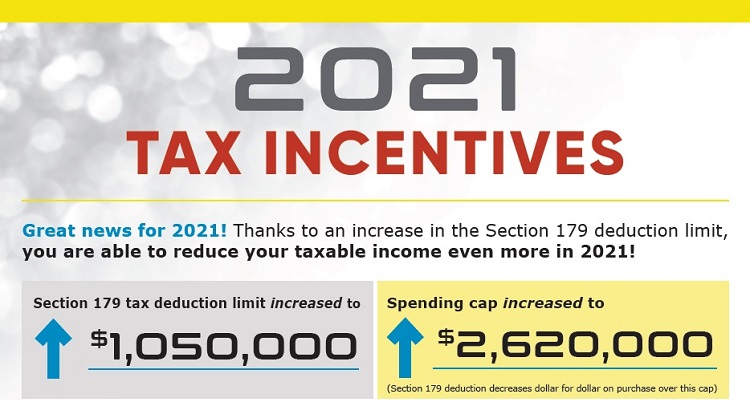

Thanks to an increase in the Section 179 deduction limit, you are able to reduce your taxable income even more in 2021!

2021 Deduction Limit = $1,050,000

Now you may be able to deduct from your 2021 taxable income the full cost of qualifying new and used equipment purchased and placed into service in 2021, up to $1,050,000.

2021 Spending Cap on Equipment Purchases = $2,620,000

The deduction is reduced “dollar-for-dollar” to the extent that qualifying new and used equipment of $2,620,000 or more is purchased and placed into service, and is completely phased out if $3,670,000 or more is purchased and placed into service.

Bonus Depreciation is 100% for 2021

Before 2020 comes to an end, take advantage of this opportunity to invest in your business. For more details and information about Section 179, please visit section179.org.

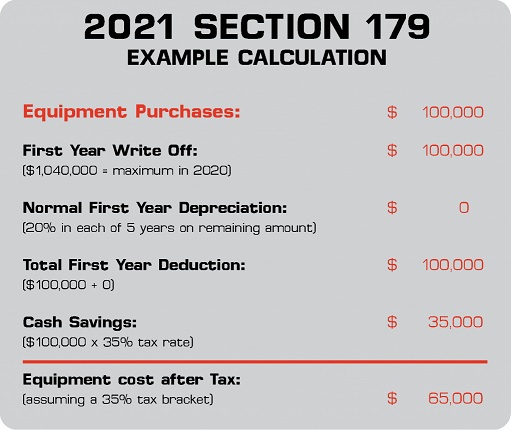

Here is an updated example of Section 179 at work during the 2021 tax year.

Still, need to purchase before the year is over? Check out our available equipment and give us a call!

*GT Mid Atlantic does not provide tax, legal or accounting advice. All customers are encouraged to seek their own professional advice on the proper treatment of these transactions. For more details and information about Section 179, please visit section179.org.